Advanced forex trading techniques for experienced traders

Ngày đăng: 1/8/2025 9:36:59 AM - Việc tìm người - Toàn Quốc - 69Chi tiết [Mã tin: 5779739] - Cập nhật: 32 phút trước

For seasoned Forex traders, mastering the basics is just the beginning. The real challenge lies in developing advanced techniques that provide a competitive edge and maximize profitability in the fast-paced Forex market. In this post, we will explore several advanced strategies and how utilizing the best forex trading platforms can enhance your ability to implement them effectively.

Price Action Trading

Price action trading is one of the most effective advanced strategies in Forex. It focuses on analyzing price movements and using historical data to predict future market behavior. This technique involves studying candlestick patterns, support and resistance levels, and market structure, rather than relying on indicators.

Experienced traders often rely on price action to make swift decisions, as it provides real-time insight into market sentiment. When paired with the best forex trading platforms, price action traders can access high-quality charts, advanced drawing tools, and precise order execution, all of which are essential for success.

Swing Trading

Swing trading is a medium-term trading strategy designed to capitalize on price "swings" within a prevailing trend. Swing traders usually hold positions from several days to weeks, seeking to profit from market fluctuations. This strategy demands a solid understanding of technical analysis, including identifying key support and resistance levels.

To identify potential swing trades, traders use oscillators like the RSI or MACD to detect overbought or oversold conditions. The best forex trading platforms offer powerful charting tools and indicators that help traders effectively apply these technical signals.

Read more: How to Use Elliott Wave Theory in Forex Trading

Scalping

Scalping is a fast-paced strategy that involves making numerous trades within short timeframes to capitalize on small price movements. Scalpers look for quick profits from a large number of trades, usually executed within seconds or minutes. This strategy requires impeccable timing, quick decision-making, and the ability to manage multiple positions at once.

To execute a successful scalping strategy, access to a best forex trading platform with ultra-low latency, fast order execution, and real-time data is crucial. Speed and precision are key factors in scalping, and top platforms provide these features to ensure that trades are executed as swiftly as possible.

Algorithmic Trading

Algorithmic trading involves using computer programs to execute trades based on specific algorithms. These algorithms are designed to follow predetermined rules regarding market conditions, technical indicators, and price patterns. Algorithmic trading offers the benefit of removing emotions from the decision-making process, allowing for more disciplined and efficient trading.

By leveraging the best forex trading platforms, traders can access automated trading features, backtest strategies, and implement algorithms with minimal effort. These tools help optimize trading strategies and reduce human errors, providing an edge in a highly competitive market.

Read more: The Most Profitable Forex Trading Systems Revealed

Carry Trading

Carry trading involves borrowing funds in a currency with a low interest rate and using them to purchase a currency with a higher interest rate. Traders profit from the interest rate differential, known as the carry, as well as potential price appreciation. This strategy is ideal for long-term positions.

To implement carry trades successfully, traders must monitor interest rates and economic indicators. The best forex trading platforms offer real-time news feeds, economic calendars, and in-depth market analysis to help traders stay informed and make timely decisions.

Hedging

Hedging is a risk management strategy used to protect open positions from adverse price movements. It involves taking offsetting positions in related currency pairs to reduce exposure to market volatility. Hedging is particularly valuable during uncertain or volatile market conditions.

The best forex trading platforms provide traders with advanced risk management tools, such as customizable stop-loss and take-profit orders, to execute hedging strategies effectively. The ability to manage multiple positions at once, combined with precise order execution, is essential for successful hedging.

To succeed in the competitive world of Forex trading, experienced traders must refine their skills and embrace advanced strategies. Price action trading, swing trading, scalping, algorithmic trading, carry trading, and hedging are all powerful techniques that can significantly enhance your trading performance.

The right tools, especially the best forex trading platforms, are essential to executing these strategies effectively. These platforms offer features such as real-time market data, advanced charting tools, automated trading options, and precise order execution. By utilizing the most advanced techniques and the right platform, you can take your Forex trading to the next level

Tin liên quan cùng chuyên mục Việc tìm người

2

2Lô đất hẻm 773 nguyễn duy trinh dt 87m vị trí đẹp

Cập nhật: 48 phút trước 2

2Cho thuê 100m2 đất dài hạn, đất hẻm 3m, gần đầm sen, hoà sơn, hòa liên, hoà vang, đà nẵng

Cập nhật: 36 phút trước 2

2Sát mt! bán nhà 3 tầng cực đẹp nguyễn văn trỗi, 62m2, chỉ 9 tỷ tl

Cập nhật: 13 phút trước 2

2Ở ngay! bán nhà đẹp 4 tầng nam kỳ khởi nghĩa, 68m2, chỉ 12.3 tỷ tl

Cập nhật: 15 phút trước![[cho thuê] 1200m² kho xưởng kcn quang minh. pccc vòng ngoài. container đỗ cửa](/img/noimage.jpg) 2

2[cho thuê] 1200m² kho xưởng kcn quang minh. pccc vòng ngoài. container đỗ cửa

Cập nhật: 1 phút trước 2

2Tại sao căn nhà phố 72 m² đất này tại thủ đức lại đáng để xuống tiề.n lúc này? hẻm xe tải 1 trục...

Cập nhật: 47 phút trước 2

2Chủ nhà cần bán gấp căn góc view thoáng – chung cư thanh hà

Cập nhật: 19 phút trước 2

2Đất hẻm liên hiệp cũ, trung tâm đức trọng, lâm đồng

Cập nhật: 20 phút trước 2

2Đất hẻm liên hiệp cũ, trung tâm đức trọng, lâm đồng

Cập nhật: 20 phút trước 2

2Đất hẻm liên hiệp cũ, trung tâm đức trọng, lâm đồng

Cập nhật: 23 phút trước 2

2Bán biệt thự thạnh mỹ lợi, 550 m², ngang 25m, bán hầm + trệt + 2 lầu, 4pn, gara ô tô

Cập nhật: 51 phút trước- 0

Clairlite : dispositif de désinfection uv, protection avancée contre les germes!

Cập nhật: 26 phút trước  2

21 lô duy nhất đất gần ngã 5 đại học, đà lạt chỉ 7.7 tỷ

Cập nhật: 50 phút trước 2

2Bán nhà c4 hẻm dh3 tân phú, tân hội, đức trọng cũ, lâm đồng

Cập nhật: 54 phút trước 2

2Bán nhà sàn homestay mới thuộc đông anh 3, nam ban, lâm hà

Cập nhật: 58 phút trước 2

2Bán đất sẵn nhà c4 hẻm ninh gia đức trọng cũ, lâm đồng

Cập nhật: 2 phút trước 2

2Mặt tiền quốc lộ 20, ngay cầu đại ninh, ninh gia, đức trọng, lâm đồng

Cập nhật: 2 phút trước 2

2Cần bán 2,4 ha đất hẻm thuộc n,thôn hạ đức trọng cũ, lâm đồng

Cập nhật: 3 phút trước 2

2Bán nhà chính chủ, mặt tiền lê thị pha, đức trọng, lâm đồng

Cập nhật: 3 phút trước 2

21 lô đất thuộc xã ninh gia, đức trọng cũ, lâm đồng, sau bách hóa xanh đi vào

Cập nhật: 3 phút trước 2

2Đất hẻm thống nhất, đức trọng, lâm đông, 346m2 chỉ 3,5 tỷ, có bớt

Cập nhật: 4 phút trước 2

2675m2 mặt tiền ql20, liên đầm, di linh, lâm đồng

Cập nhật: 4 phút trước 2

2Nhà vườn nghỉ dưỡng mặt tiền chính tỉnh lộ 724, tân hội, lâm đồng

Cập nhật: 4 phút trước 2

2Bán đất sẵn nhà tiền chế hẻm tổ 32, liên nghĩa, đức trọng

Cập nhật: 4 phút trước 2

2Đất 3 mặt tiền nhựa tân phú, ninh gia, lâm đồng qua cầu tân bình một đoạn

Cập nhật: 4 phút trước 2

2Đất trung tâm đức trọng, lâm đồng, gần hồ nam sơn

Cập nhật: 5 phút trước 2

24 sào hẻm ql27, dran, đơn dương, lâm đồng

Cập nhật: 6 phút trước 2

2Gần 1,1 ha ( chỉ 11,5 tỷ ), hẻm ba cản, tân hội, đức trọng cũ, lâm đồng

Cập nhật: 6 phút trước 2

24,6 sào đất ninh gia, đức trọng cũ, lâm đồng, oto, xe tải vào tận nơi

Cập nhật: 6 phút trước 2

2Đất mặt tiền nhựa chính kcn phú hội, đức trọng, lâm đồng

Cập nhật: 12 phút trước 2

2Bán nhà xuân đỉnh 38 mét 4 tầng 10,2 tỷ

Cập nhật: 10 phút trước 2

2Bán nhà xuân đỉnh 66m 5 tầng 15,5 tỷ

Cập nhật: 48 phút trước 2

2Chính chủ cho thuê nhà nguyên căn đẹp, mới, full nội thất, thoáng mát đường bắc đẩu, đn

Cập nhật: 23 phút trước 2

2Bán nhà mặt tiền 215 thích thiện hòa, xã lê minh xuân, huyện bình chánh

Cập nhật: 50 phút trước 2

2Bán căn hộ lucky dragon tầng 9, đỗ xuân hợp 2pn 2wc 71m2

Cập nhật: 19 phút trước 2

2Bán căn hộ tập thể tầng 1 giá 3,2 tỷ, sổ đỏ chính chủ

Cập nhật: 6 phút trước 2

2Cho thuê kho xưởng sạch đẹp tại thôn nhuế, kim chung. đông anh.

Cập nhật: 52 phút trước 2

2Nhà đẹp giá tốt homestay 2 tầng kiệt , điện biên phủ, thành phố huế , doanh thu ổn định

Cập nhật: 14 phút trước 2

2Nhà đẹp giá tốt homestay 2 tầng kiệt , điện biên phủ, thành phố huế , doanh thu ổn định

Cập nhật: 14 phút trước- 0

Vital hemp your daily companion for calm balance and wellness

Cập nhật: 43 phút trước  2

2Bán 4 căn mặt tiền calmette quận 1, 310 m², ngang 13m, gần chợ bến thành

Cập nhật: 47 phút trước 2

2Bán toà nhà chdv nguyễn thượng hiền phú nhuận, 1 hầm 8 tầng, dòng tiền 400 triệu

Cập nhật: 24 phút trước 2

2Bán nhà ngõ 79 cầu giấy 33 mét 5 tầng 10,5 tỷ

Cập nhật: 12 phút trước 2

2Bán hoặc cho thuê nhà hẻm xe tải đô đốc long tân phú 2pn, 2wc

Cập nhật: 13 phút trước 2

2Bán nhà chính chủ ngay khu đồng diều hóc môn chỉ 946tr mt đường lớn

Cập nhật: 50 phút trước 2

2Cho thuê phòng trọ mới xây có gác lững ở 242/23 tô hiệu, liên chiểu, đà nẵng.

Cập nhật: 10 phút trước 1

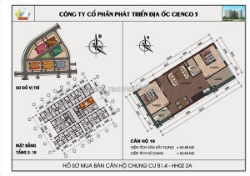

1Cho thuê căn hộ 70m2 chung cư thanh hà cienco5

Cập nhật: 25 phút trước 2

2Chính chủ bán gấp biệt thự 200m2 tại khu tên lửa, bình tân

Cập nhật: 49 phút trước 2

2Chỉ 2,5x tỷ sở hữu ngay căn pen 2pn tại kđt thanh hà

Cập nhật: 6 phút trước- 0

Vital hemp a natural way to support relaxation sleep and everyday wellness

Cập nhật: 41 phút trước

![[cho thuê] 1200m² kho xưởng kcn quang minh. pccc vòng ngoài. container đỗ cửa](/Img/2026/3/cho-thue-1200m-kho-xuong-kcn-quang-minh-pccc-vong-ngoai-container-do-cua-01.jpg?w=250)