Trading psychology basics for forex traders

Ngày đăng: 9/22/2025 3:37:00 PM - Máy PC, Laptop - Toàn Quốc - 33Chi tiết [Mã tin: 6235531] - Cập nhật: 29 phút trước

When people first enter the forex market, they often focus on technical analysis, indicators, or strategies. While these tools are valuable, many traders underestimate the importance of psychology in trading. The truth is that mindset and emotional control play just as big a role as charts and economic data. Without proper psychological discipline, even the best strategy can fail. In this article, Forex89 explores the basics of trading psychology and how traders can manage their emotions to improve decision-making.

Why Trading Psychology Matters

Forex trading isn’t just about predicting price movements it’s also about managing risk and executing trades with discipline. Market conditions often change rapidly, and traders face constant uncertainty. Emotions like fear and greed can cloud judgment, leading to poor decisions such as holding onto losses too long or chasing after profits impulsively.

Good trading psychology helps traders:

- Stick to their plan without second-guessing every move.

- Avoid overtrading or revenge trading after a loss.

- Maintain discipline even during periods of volatility.

- Develop confidence in their strategy.

Simply put, your mindset can be the difference between consistent profits and repeated mistakes.

Common Emotional Challenges in Forex Trading

Fear: Traders often fear losing money, missing out on opportunities, or being wrong. Fear can cause hesitation, leading to missed trades or closing positions too early.

Greed: The opposite of fear, greed pushes traders to risk more than they should. Overleveraging or ignoring stop-loss orders are common outcomes of greed-driven trading.

Overconfidence: After a winning streak, traders may become too confident and take unnecessary risks, forgetting that markets can turn unexpectedly.

Frustration: Losses are part of trading, but frustration can lead to revenge trading trying to recover losses too quickly, often resulting in deeper setbacks.

Recognizing these emotions is the first step toward managing them effectively.

Techniques to Improve Trading Psychology

Create and Follow a Trading Plan

A well-defined trading plan outlines entry and exit points, risk management rules, and position sizing. Sticking to this plan reduces the influence of emotions because decisions are based on logic rather than impulse.

Practice Patience

Successful forex trading isn’t about constant action it’s about waiting for the right setup. Patience helps traders avoid forcing trades in uncertain conditions.

Use Risk Management Tools

Implement stop-loss orders and avoid risking more than a small percentage of your account on any single trade. Knowing your potential loss in advance reduces fear and builds confidence.

Keep a Trading Journal

Recording your trades and emotional state during decision-making can reveal patterns in your behavior. Over time, this journal helps you identify strengths and weaknesses in your psychology.

Embrace Losses as Learning

Losses are inevitable in forex trading. Instead of viewing them as failures, treat them as opportunities to improve. This mindset shift reduces frustration and promotes growth.

The Role of Mindfulness in Trading

Mindfulness practices, such as meditation or controlled breathing, can help traders stay calm during stressful market conditions. By focusing on the present moment, traders reduce anxiety and avoid impulsive decisions.

Even short daily exercises can strengthen mental resilience, which is essential for handling the ups and downs of trading.

Building Long-Term Psychological Strength

Just like trading strategies, psychological discipline requires ongoing development. Over time, traders who consistently work on their mindset gain a competitive edge. They learn to accept uncertainty, manage risk with confidence, and make rational decisions under pressure.

Final Thoughts

In forex trading, mastering psychology is just as crucial as understanding technical and fundamental analysis. By managing emotions like fear, greed, and overconfidence, traders can approach the market with discipline and clarity.

At Forex89, we believe that developing strong trading psychology gives traders a lasting advantage. Whether you’re a beginner or an experienced investor, focusing on your mindset can help you achieve more consistent results and long-term success in the forex market.

See more: https://forex89.com/contact-forex89/

Tin liên quan cùng chuyên mục Máy PC, Laptop

2

2Chính chủ gửi bán gấp nền đất đẹp đông hưng thuận q12 – hẻm 6m yên tĩnh!

Cập nhật: 2 phút trước 2

2Nhà mới 3 tầng (5x22) mặt tiền đình quới an – đối diện phương đông garden

Cập nhật: 6 phút trước- 0

Thủ tục đăng ký tên thương hiệu tại việt nam theo quy định mới 2024

Cập nhật: 6 phút trước  2

2Bán nhà chia lô cầu diễn 37m2x5t, thang máy, ô tô,ở ngay, tặng full đồ, 8.5 tỷ

Cập nhật: 9 phút trước- 0

Đèn led pha cho cây giống hiện nay

Cập nhật: 12 phút trước - 0

Bảo hộ tên thương mại: có cần phải đi đăng ký?

Cập nhật: 12 phút trước - 0

Thành lập công ty có phải chứng minh vốn điều lệ không ?

Cập nhật: 15 phút trước - 0

Dịch vụ đăng ký thành lập công ty doanh nghiệp tại hcm

Cập nhật: 17 phút trước - 0

Đèn led pha cho thu hoạch cây ở vn

Cập nhật: 31 phút trước  1

1Tuyển nv seller support executive có kn ngành thương mại điện tử

Cập nhật: 39 phút trước- 0

Khóa cửa lùa thông minh: giải pháp an ninh hiện đại cho không gian tinh tế 2026

Cập nhật: 43 phút trước - 0

Đèn led pha cho trang trại tại hn

Cập nhật: 44 phút trước - 0

Đèn led pha cho trang trại tại hn

Cập nhật: 45 phút trước - 0

Chính chủ cần bán nhà phố ngọc trục đại mỗ quận nam từ liêm 35 m2 x 5 t nhỉnh 3

Cập nhật: 52 phút trước - 0

Cần bán nhà chính chủ phố doãn kế thiện quận cầu giấy 62 m2 x 7 t tỷ thang

Cập nhật: 53 phút trước - 0

Cần bán nhà chính chủ quận thanh xuân bán nhà phố phùng khoang 36 m3 x4 t 4.5

Cập nhật: 54 phút trước - 0

Chính chủ cần bán nhà phố ngọc trục đại mỗ quận nam từ liêm 35 m2 x 5 t nhỉnh 3

Cập nhật: 55 phút trước - 0

Cần bán nhà chính chủ quận cầu giấy phường quan hoa 50 m2 x6 t 9.3 tỷ ô tô kd

Cập nhật: 56 phút trước - 0

Cần bán nhà chính chủ phố lê quang đạo quận nam từ liêm 40 m2 x 5 tầng nhỉnh 5

Cập nhật: 56 phút trước - 0

Chính chủ cần bán căn hộ cccc masteri tây mỗ quận nam từ liên 54 m2 4,95 tỷ tòa

Cập nhật: 58 phút trước - 0

Cần bán nhàchính chủ quận nam từ liêm phố mỹ đình 52 m2 x 5 t 6.8 tỷ ô tô kd

Cập nhật: 1 phút trước - 0

Chính chủ cần bán phố đình quán quận bắc từ liêm 63 m x 4 t mt rộng nhỉnh 10 tỷ

Cập nhật: 1 phút trước - 0

Chính chủ cần bán nhà quận cầu giấy phố nguyễn ngọc vũ 40 m2 x 4 t 7 tỷ ô tô

Cập nhật: 2 phút trước - 0

Chính chủ cần bán mảnh đất phố cầu cốc phường tây mỗ quận nam từ liêm 41m2 mt

Cập nhật: 2 phút trước - 0

Chính chủ cần bán nhà phố lê quang đạo quận nam từ liêm 50 x 7 t nhỉnh 9 tỷ mt

Cập nhật: 4 phút trước  1

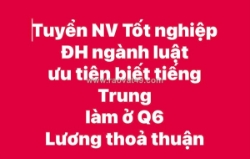

1Tuyển nv tốt nghiệp đh ngành luật ưu tiên biết tiếng trung làm ở q6

Cập nhật: 5 phút trước- 0

Chính chủ cần bán nhà phố trần quốc hoàn quận cầu giấy45m2 x4 t 8,5 tỷ ô tô kd

Cập nhật: 7 phút trước - 0

Chính chủ cần bán nhà phú đô, bán đất tặng nhà 35m2x1t, mt rộng, nhỉnh 2 tỷ

Cập nhật: 8 phút trước - 0

Chính chủ cần bán nhà phố hào nam quận đống đa 48 m2 x 4 t nhỉnh 6 tỷ ô tô kd

Cập nhật: 10 phút trước - 0

Chính chủ cần bán nhà nguyễn đổng chi quận nam từ liêm 32m2 x 5 t 5,6 tỷ ô tô kd

Cập nhật: 10 phút trước - 0

Siêu hót chính chủ cần bán nhà phố nghĩa tân quận cầu giấy 40 m2 x 3 t nhỉnh 15

Cập nhật: 10 phút trước - 0

Cần bán nhàchính chủ quận nam từ liêm phố mỹ đình 52 m2 x 5 t 6.8 tỷ ô tô kd

Cập nhật: 13 phút trước - 0

Chính chủ cần bán nhà quận đống đa bán nhà phố thái thịnh 52m2 x 5t9.5 tỷ ô tô

Cập nhật: 13 phút trước - 0

Cần bán nhàchính chủ quận nam từ liêm phố mỹ đình 52 m2 x 5 t 6.8 tỷ ô tô kd

Cập nhật: 14 phút trước - 0

Chính chủ cần bán nhà quận nam từ liêm phố đình thôn 47 m2 x6 t 6.75 tỷ ô tô kd

Cập nhật: 16 phút trước - 0

Cực hiếm chính chủ cần bán phố tây mỗ quận nam tư liêm 60 m2 x 4 t nhỉnh 8 tỷ ô

Cập nhật: 19 phút trước - 0

Chính chủ cần bán nhà vị trí cực hiếm nhà phố cự lộc thanh xuân 35m2 x5 t 7,38

Cập nhật: 20 phút trước  1

1Đến hạn trả nợ tôi chính chủ cần bán lô đất hàng xóm đô thị xanh vilas

Cập nhật: 22 phút trước- 0

Cần bán nhà chính chủ phố mễ trì thượng quận nam từ liêm 45 m2 x 5 t nhỉnh 7 tỷ

Cập nhật: 24 phút trước  1

1Chính chủ cần nhượng lại lô góc đất nghỉ dưỡng hà nội cạnh phân khu hòa lạc 3

Cập nhật: 25 phút trước- 0

Chính chủ cần bán mảnh đất quận tây hồ 265 m2 mt 35 m 47 tỷ

Cập nhật: 28 phút trước - 0

Chính chủ cần bán nhà phố khương trung quận thanh xuân 35 m2 x 3 t3,6 tỷ ô tô kd

Cập nhật: 30 phút trước - 0

Cực hiếm hót chính chủ cần bán lô đất xã cần kiệm cạnh khu công nghệ cao láng

Cập nhật: 31 phút trước - 0

Cần bán nhàchính chủ quận nam từ liêm phố mỹ đình 52 m2 x 5 t 6.8 tỷ ô tô kd

Cập nhật: 34 phút trước - 0

Chính chủ cần bán gấp mảnh đất lê quang đạo quận nam từ liêm 112 m2 m t rộng

Cập nhật: 34 phút trước - 0

Chính chủ cần bán nhà quận cầu giấy phường quan hoa 50 m2 x6 t 9.3 tỷ ô tô kd

Cập nhật: 34 phút trước - 0

Chính chủ cần bán tòa nhà ccmn phố đồng bát quận nam từ liên 90 m2 x 9 t nhỉnh

Cập nhật: 37 phút trước - 0

Cực hiếm chính chủ cần bán nhà phố trần quốc toản quận hoàn kiếm 87m2 x4 t

Cập nhật: 37 phút trước  1

1Đến hạn trả nợ tôi chính chủ cần bán lô đất hàng xóm đô thị xanh vi

Cập nhật: 40 phút trước- 0

Cần bán mảnh đát chính chủ đường láng hòa lạc 65 m2 giá nhỉnh 1 tỷ ô tô 4 làn

Cập nhật: 41 phút trước